The latest news shows that the behind of rising copper price is likely to be Shanxi coal boss. Reuters quoted sources, a private coal industry investors in Shanxi is the main promoter of a substantial increase in the number of copper, whose holdings of futures positons close to 3 billion US dollars, driving copper price rising to a 4-year high.

The person said that these position was hoarded i by futures broker Green Dahua futures company n the past year.

Goldman Sachs raised its copper target price sharply

Wall street news, Goldman Sachs raised their estimates of copper price sharply, which is to be adjusted nearly 30% for the next 12 months.

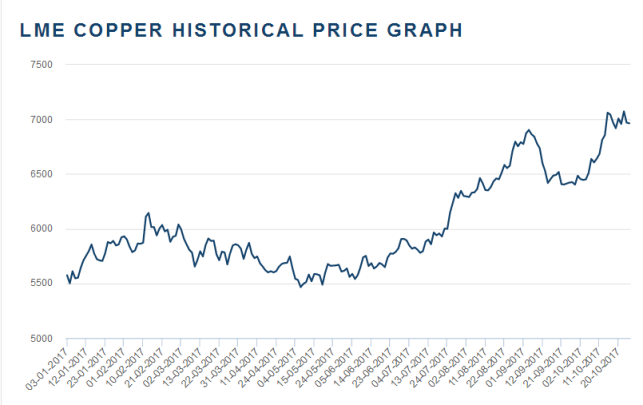

Goldman Sachs believes that in the next five years, copper prices will be in the uplink channel, and even expected that it may break through the $8,000 mark per ton when 2020. Reason for having this expectation is that they estimate before 2018 there will be 130,000 tons of supply gap, which will support further higher of copper price.

Meanwhile, Goldman Sachs expects China’s copper demand in 2017 to grow by 3.1 percent, and the average growth rate between 2017 and 2022 will be 1.8 percent. In August this year, the main copper rose to 56140 yuan/ ton, a four-year high. LME copper also rised to 7000 USD/ ton this year.